Looking back at the 2008 financial crisis, researchers call it the worst economic disaster since the Great Depression. Trillions of dollars in value vanished as the stock market tanked between late 2007 and 2009. Unemployment rose — hitting 10 percent in October 2009 — and millions of Americans lost their homes. The crisis saw the largest bankruptcy in US history, and economists suspect that many more financial institutions would have failed if not for emergency loans from the government. Even after federal bailouts stopped the markets from hemorrhaging, aftershocks continued to shake economies worldwide.

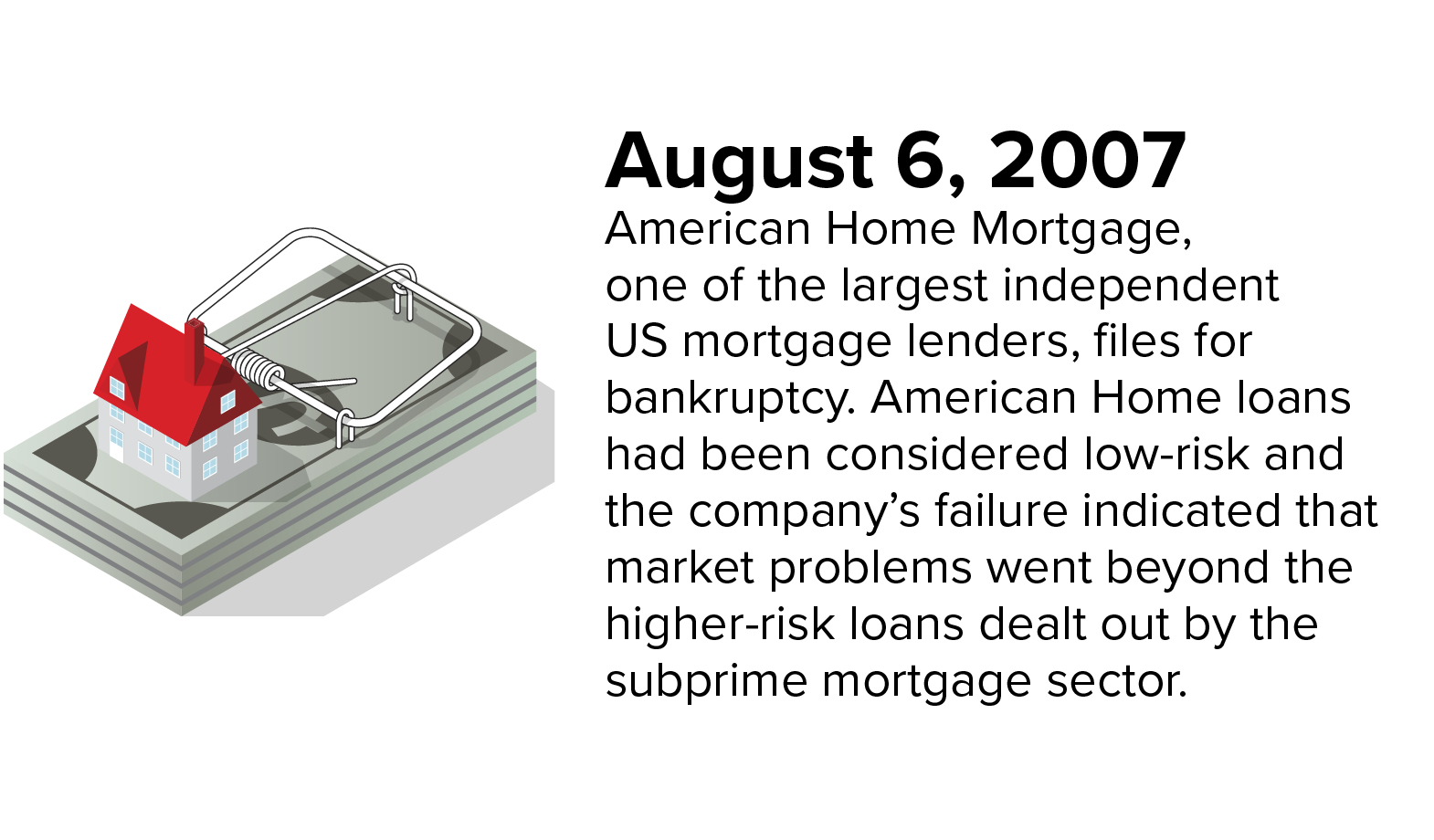

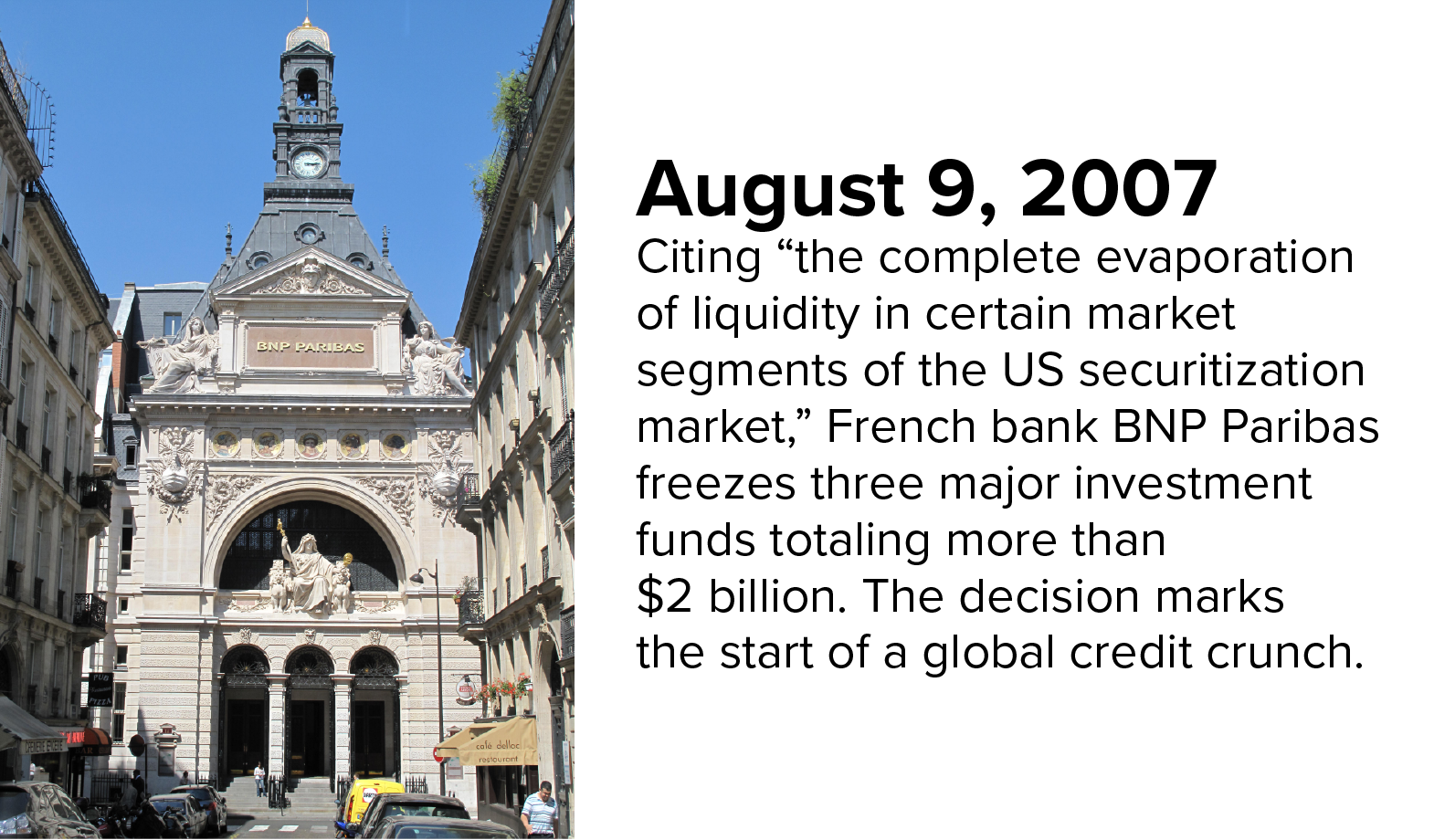

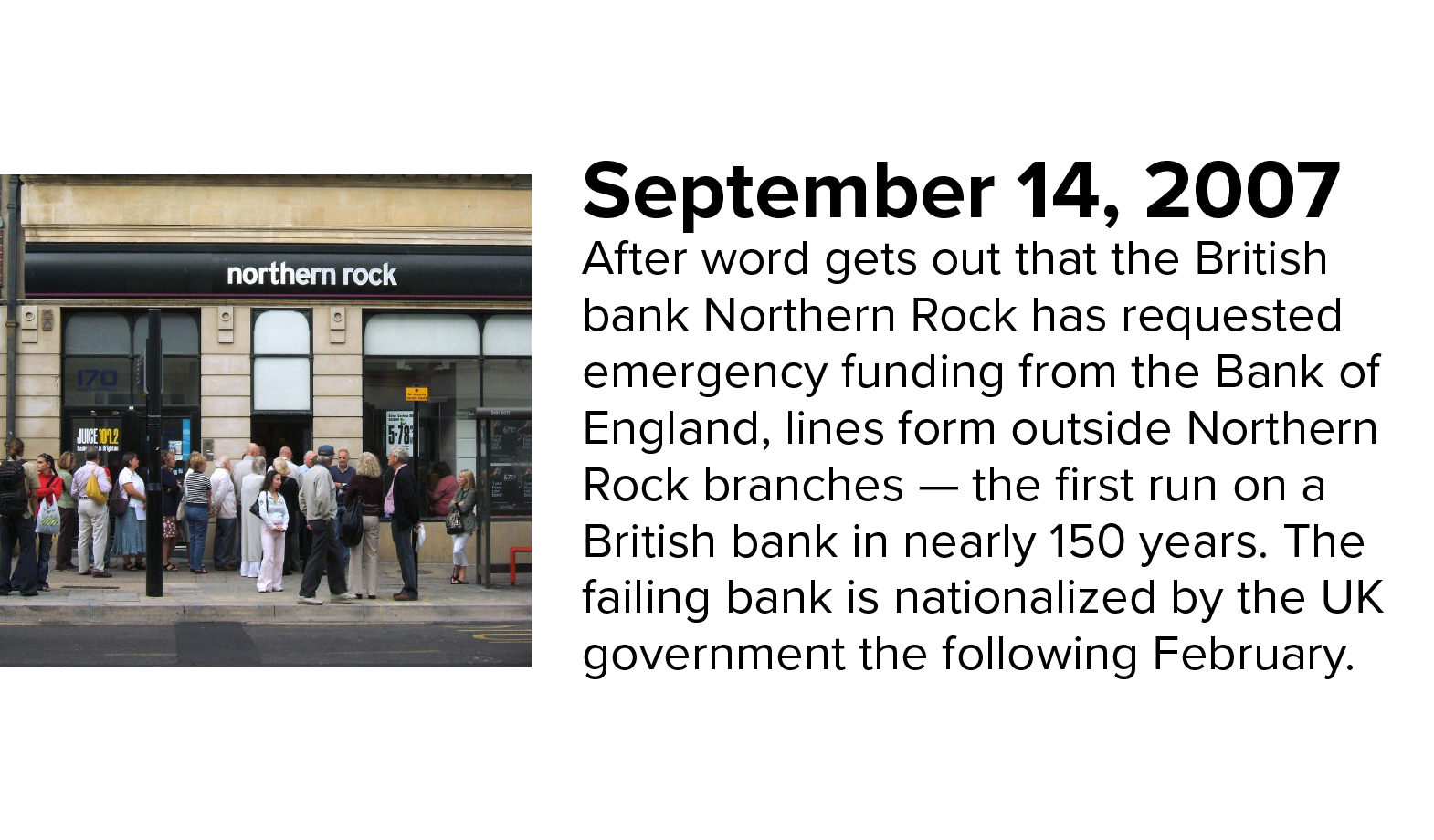

In 2007, experts and regulators were not aware how much of the financial system was built on mortgage-backed securities, bolstered by a thriving housing market. When the housing bubble burst, it didn’t take long for things to start falling apart and for people to panic. “Once we got into that mode,” says Douglas Diamond, an economist at the University of Chicago, “the crisis became a very rapidly moving target that was very hard to stop.”

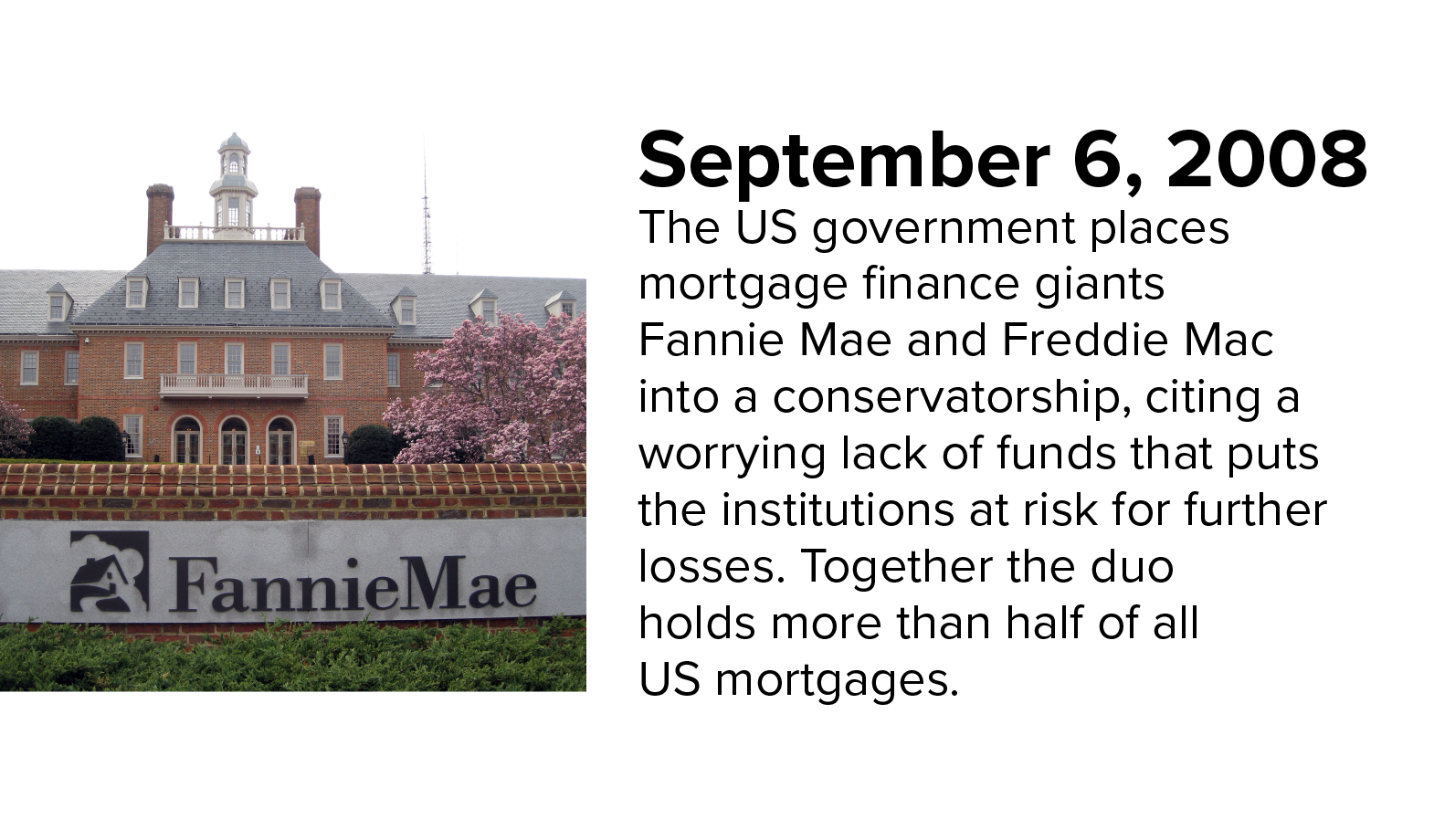

Click on the slideshow below for a look at some of the key events in the crisis, with commentary from those who lived through it:

![Quote from Douglas Diamond “Lehman was a shock. It was something that made [people] surprised. And once they are surprised and thinking about runs, then runs are very hard to avoid.“](/docserver/fulltext/10.1146/knowable-110318-1/financial-timeline-12.png)